[overview of smart financial system]

Smart finance is based on Internet technology, using big data, artificial intelligence, cloud computing and other financial technology means, so that the financial industry in terms of business processes, business development and customer service has been comprehensively improved, to achieve the wisdom of financial products, risk control, customer acquisition and service. Including 'one-stop, self-service, intelligent' new service experience of bank outlets, mobile banking app, wechat service, etc. The business processing mode has changed from 'teller Operation Oriented' to 'customer independent and self-service processing'.

The third-party platform is grafted with many traditional banking, insurance, fund, trust and other financial institutions in the industry to analyze user behavior, market, products, etc. in detail, and intelligently recommend diversified portfolio for customers. The platform is driven by data and technology. Establish a comprehensive risk control capability including user data collection, real-time computing engine, data mining platform, automatic decision engine and human assisted approval

[intelligent financial system diagram]

[application of intelligent financial system]

Smart finance is a higher stage of the evolution of traditional financial services in the Internet era. Under the intelligent financial system, users are more convenient to apply financial services, and they will not be willing to go to bank outlets for several hours because of saving money and loans.

Under the intelligent financial system, users can apply financial services more easily. After financial institutions obtain sufficient information, they can make immediate response after big data engine statistical analysis and decision-making, and provide targeted services to users to meet their needs. In addition, the open platform integrates a variety of financial institutions and intermediaries, which can provide users with a variety of financial services. These financial services are not only diversified, but also personalized. They are not only a packaged one-stop service, but also can be selected and combined by users according to their needs.

When providing services for users, financial institutions rely on big data credit to make up for the imperfection of China's credit system. During risk control, there are more data dimensions, more accurate decision engine judgment and better anti fraud effect. On the other hand, Internet technology improves the security protection of user information and funds.

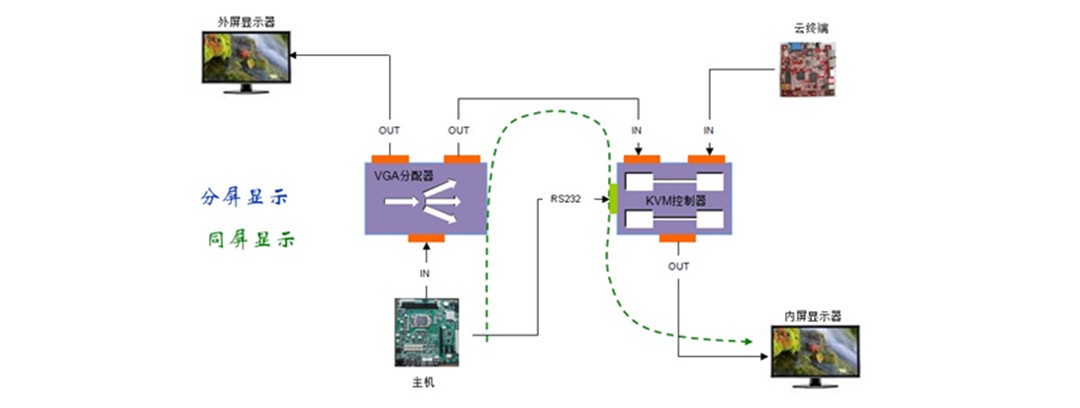

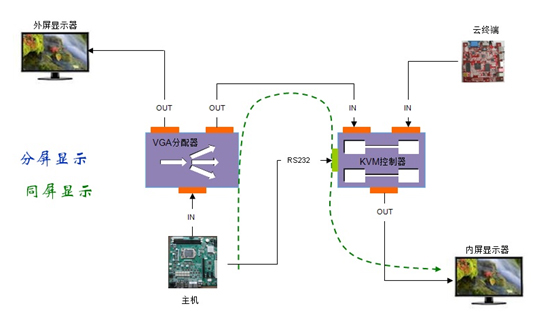

High energy computer is mainly engaged in R & D and production of stable, reliable, embedded and intelligent industrial control All-in-one equipment, customized services, providing intelligent finance, intelligent transportation, intelligent security, intelligent retail, network security and other industrial control all-in-one solutions.